My hometown on Long Island is infamous for many things: New York’s first planned community, one of the last American golf clubs that does not allow women on the grounds, the birthplace of Susan Lucci.

Mostly, though, we’re known for sending Garden City High School grads to top-tier lacrosse schools, and housing a dense population of Wall Street players. Often these are the same people.

So, most of us who grew up there know that the stock market is an insider’s game; that institutional money is what moves the numbers; that most pension-fund managers will go with whomever supplies the most strippers and cocaine on their annual jaunts to New York City; that small, independent investors, by and large, provide the funds for big-bank extravagances with their losses and fees.

It’s a casino, built on a false promise with the money of suckers. Or at least it used to be.

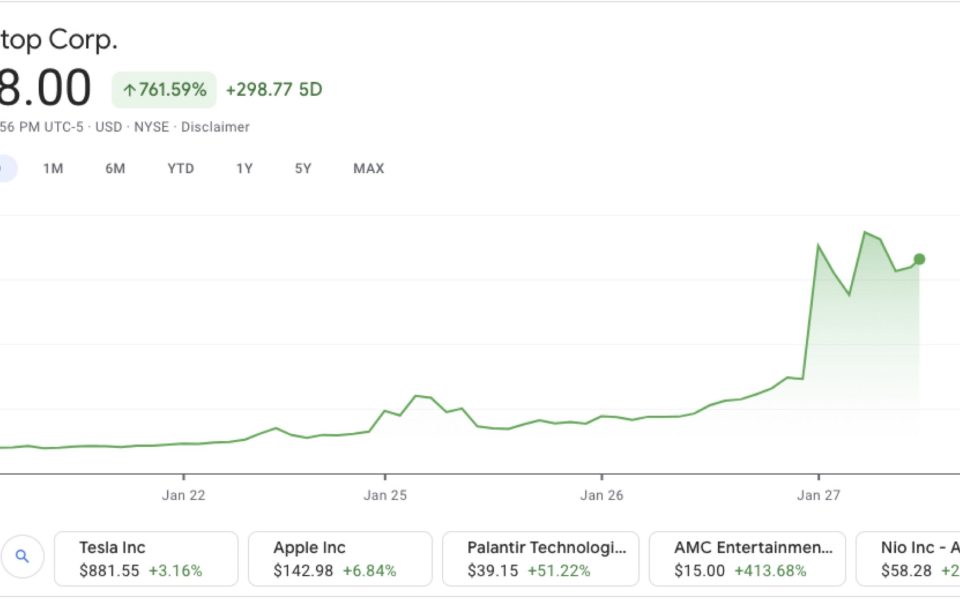

Over the last two weeks an internet-powered movement drove Game Stop (GME) stock from $19.95 per share to as high as $350 over Wednesday morning. This has nothing to do with the store — a brick-and-mortar that buys and sells video games and is by all measures suffering from the rise of the digital economy — and everything to do with the power of the smartphone masses.

Insiders had been shorting Game Stop stock, which is a way to make money when a company does poorly and often drives down its value even further. But before they could cash in their shorts, a massive group of rogue, thousands of independent investors united by a subreddit, r/wallstreetbets, started buying GME in small batches on their smartphone apps, pushing its price into the stratosphere and causing cash hemorrhages among the short-sellers, who operate on a buy-now/pay-later model.

And because the short-sellers now must pay for the stock at the new, much higher cost, it will drive the shares up even further.

The investment banks, the financial press, the big players are freaking out over this. For one, it erodes their power, already diminishing as investors turn to digital solutions over “financial advisors.” For another, it shows how easy it is to rig the system they’ve spent their careers protecting. Once again, the emperor has no clothes.

The Redditors may cash out today, realizing about 150 percent growth in their investments over just a couple weeks. Or maybe they’ll hold on, bleeding the short-sellers for another week or so. The Game Stop short-sellers have lost $6 billion so far this year.

And the game itself has just begun.

Join the First Amendment Society, a membership that goes directly to funding TCB‘s newsroom.

We believe that reporting can save the world.

The TCB First Amendment Society recognizes the vital role of a free, unfettered press with a bundling of local experiences designed to build community, and unique engagements with our newsroom that will help you understand, and shape, local journalism’s critical role in uplifting the people in our cities.

All revenue goes directly into the newsroom as reporters’ salaries and freelance commissions.

This is not “hacking” and you should feel ashamed for calling it such. Implying that they are doing something illegal when in fact they are just taking advantage of a situation caused by the hedge funds is disgusting.

As a long time editor for the technology sector I ashamed to call you a colleague. Had any of my reporters pulled this kind of stunt they would have been fitted on the spot.

@Grauenwolf lol stay mad dumbass. “Hacking” has frequently been used as to describe an unconventional way of doing things that’s more efficient/profitable than the so-called “proper” way. In that context it has nothing to do with legality. Have you never heard the word “lifehack?”