The Triad is a metropolitan area in the north-central part of North Carolina. It includes three major cities, Greensboro, Winston-Salem, and High Point, as well as nearby communities. As in other regions, many people here lose their jobs every year, and most layoffs occur in manufacturing, transportation, retail, and healthcare. When people lose their income, they immediately face the question of how to pay for housing, utilities, food, medical care, and transportation. How do Triad residents cope with this? You will find out in the article below.

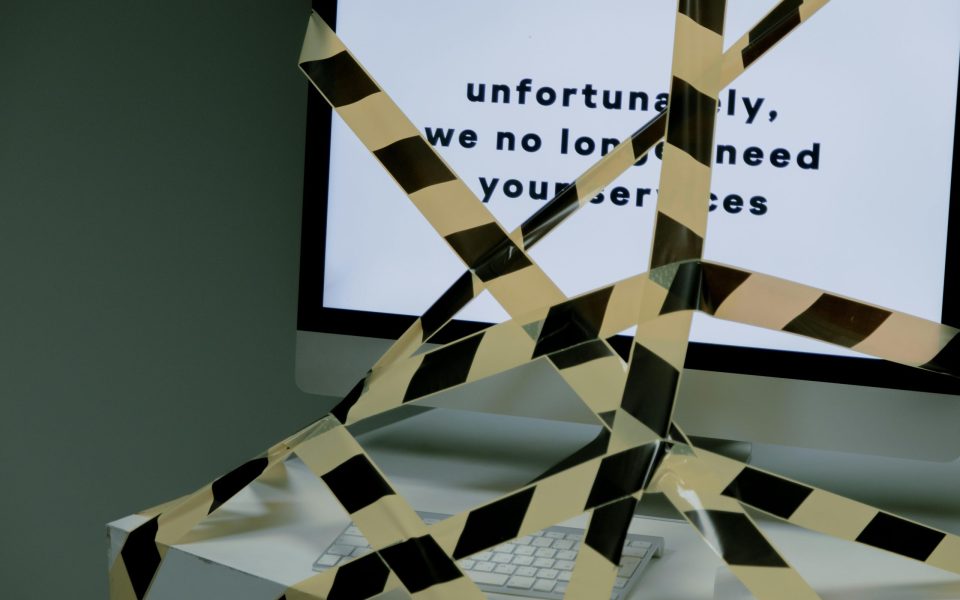

What Job Loss Looks Like in the Triad Today

The Triad’s economy relies on manufacturing, logistics, education, and healthcare. These sectors provide many jobs, but they are sensitive to economic changes, so layoffs are common in the region. The unemployment rate in the Greensboro–High Point area remains at 4–5%, which is higher than the state average. Many residents work hourly, so most do not have enough savings, and losing a job quickly leads to financial difficulties.

Local companies often publish WARN notices, official announcements about upcoming mass layoffs required by federal regulations. These notices often mention job cuts in the furniture industry, transportation, and warehouse operations. People working in these areas usually lose their income suddenly and have no time to prepare.

Job loss affects more than just a paycheck. A person may lose medical insurance, regular pension contributions, and a stable schedule. If a family relies on a single source of income, the situation becomes even harder.

Immediate Steps to Protect Your Essential Expenses

After losing a job, it is important to review your finances right away. You need to look at your remaining income, upcoming mandatory payments, and available resources. This helps you understand what needs to be paid first. Financial counselors usually suggest focusing on the most important expenses: housing, utilities, food, transportation, and medical care. It’s better to cut all secondary expenses for now.

You should also inform your mortgage company, landlord, and utility providers about your situation. Many organizations in North Carolina offer support programs that include flexible terms or temporary payment reductions. These programs do not eliminate the debt, but they help avoid shut-offs and late penalties.

You need to file an unemployment claim as early as possible. In North Carolina, payments begin after the claim is approved and the one-week waiting period has passed. The state’s Division of Employment Security manages these benefits. To prevent delays, it is important to prepare all required documents: recent pay stubs, the layoff notice, and your employment history. These payments cover part of the lost income and give you time to search for a new job.

Housing Costs and Local Resources in the Triad

Housing typically accounts for the largest share of a family’s monthly expenses. When a person loses income, regular rent or mortgage payments become a heavy burden. Under North Carolina law, landlords can begin the eviction process for nonpayment, but in practice, many try to avoid this. Such a process is long and expensive, so open communication and attempts to reach an agreement are very important.

In the Triad region, there are local programs that help renters and homeowners. The Guilford County Department of Social Services offers various economic services, including food assistance, help with paying bills, and assistance with housing-related expenses.

In Forsyth County, which includes most of Winston-Salem, emergency assistance is available to cover rent or utility bills. It is provided under certain conditions, most often to families with children.

If a person has a mortgage, it is important to contact their lender as early as possible. Many lenders are willing to offer a payment deferral, a new repayment schedule, or a change in loan terms for those who have lost income. Timely contact helps avoid the start of foreclosure proceedings.

Renters should also reach out to housing counseling agencies. These organizations help discuss payment options, explain renters’ rights, and assist with applying for support programs.

Utilities and Everyday Services You Must Keep Running

Public utilities in North Carolina include electricity, water, sewer, gas, and internet. The state’s Utilities Commission oversees the operation of the electric system. Large providers such as Duke Energy and Piedmont Natural Gas have support programs for customers who temporarily cannot pay their bills.

If a family has difficulty paying, it is important to contact each service provider right away. Many companies offer extended payment deadlines, payment deferral plans, discounts for low-income households, or one-time assistance from special funds.

In Guilford and Forsyth counties, the Crisis Intervention Program is available. It helps people who need to pay for heating or cooling urgently. The program uses federal funds from the Low-Income Home Energy Assistance Program. To receive support, households must meet income requirements.

It is also worth checking your internet plan. Some residents may qualify for discounted programs offered by major providers. Reliable internet access is important for job searches, filing unemployment claims, and communicating with employers.

Food and Household Essentials When Money Is Tight

Reducing food expenses is easier with the help of local support programs. The “Food and Nutrition Services of North Carolina” program provides monthly benefits on an electronic card. Eligibility is calculated based on income, expenses, and family size. If a person has lost their job, they should apply right away, because after income decreases, the chances of receiving support are usually higher.

The Triad has a well-developed network of community food programs. The Second Harvest Food Bank in the northwest part of the state supplies many local pantries. Local churches and nonprofit organizations hold regular food distributions. Their schedules should be checked on official websites, as the time and locations may change.

Many grocery stores offer loyalty programs and digital coupons. Planning meals, choosing well-known brands, and buying long-shelf-life products in bulk help reduce costs. Families often combine government benefits with support from local organizations to lower food expenses without reducing the quality of their meals.

Health Care, Prescriptions, and Affordable Local Clinics

After losing a job, people often lose the employer-sponsored health insurance they had. This creates serious difficulties, especially if the family needs treatment, prescriptions, or mental health support.

In North Carolina, on December 1, 2023, the ACA expanded access to the Medicaid program. This enabled more than 600,000 North Carolina residents to access medical services in the very first year.

Today, adults aged 19 to 64 can qualify if their household income does not exceed 138% of the federal poverty level. For an adult in a two-person household, this is about $1,800 per month before taxes. For larger families, the threshold is higher and depends on the number of family members. An application can be submitted through the ePass portal or on the HealthCare.gov website.

In addition to Medicaid, low-income residents of the Triad can seek help at local clinics and public health facilities. These include county health departments, nonprofit clinics, and centers with flexible appointment schedules. They provide primary care, vaccinations, mental health support, and assistance with prescriptions.

If a person needs regular medications or ongoing treatment, seeking help through these clinics or nonprofit centers can significantly reduce medical expenses.

How to Use North Carolina Unemployment Benefits Wisely

Unemployment benefits are the primary temporary source of income for many Triad residents. The North Carolina Division of Employment Security sets the rules for receiving these benefits. They take into account previous wages, work experience, and the reason for dismissal. To continue receiving payments, you must submit a weekly certification.

The maximum benefit amount in the state is $350 per week. The exact amount depends on the wages reported by the employer. These funds are usually used to cover the most essential expenses. Unemployment benefits are taxed, so many people choose to have taxes withheld immediately to avoid debt later.

People looking for work must document their job search efforts. The Division of Employment Security requires noting the date, the employer’s name, the method of contact, and the result. Such records help avoid delays and denials.

Residents can seek help at NCWorks centers in Greensboro, High Point, and Winston-Salem. These centers assist with preparing résumés, offer training, and help find suitable job openings. These services help shorten the period of unemployment and make it easier to regain a stable income.

When Small, Short-Term Loans Can Help Bridge the Gap

When income drops suddenly, and residents still face urgent expenses like utilities, rent, and essential repairs, some turn to short-term NC cash support for urgent expenses. But such loans should be used only when a person understands the full cost, the repayment terms, and the requirements for the borrower.

Credit unions in the Triad, such as Truliant Federal Credit Union and the State Employees’ Credit Union, offer small loan products. Interest rates on these loans are usually lower, and many residents can join these organizations based on where they live or work.

In North Carolina, traditional payday loans are prohibited. The Consumer Finance Act limits interest rates on most small loans to 36%. This protects residents from excessively high costs. Therefore, it is important to avoid unlicensed lenders and online companies that violate state rules. The North Carolina Office of the Commissioner of Banks publishes a list of lenders that have an official license.

Community Aid, Faith-Based Charities, and Triad Nonprofits

In the Triad, there is a large network of community organizations that help people who are facing financial difficulties. They provide food, help with rent, offer transportation support, and assist with various everyday needs. Usually, to participate in these programs, residents must confirm job loss, reduced income, or a change in household size.

The main nonprofit organizations include:

- The Salvation Army of Greensboro, Winston-Salem, and High Point

- United Way of Greater Greensboro and United Way of Forsyth County

- Greensboro Urban Ministry

- Crisis Control Ministry

- Housing and Hope

- Shepherd’s Center programs for older adults

Religious organizations also assist. Many churches offer emergency help or work together with local partners. Their official websites usually list contact information and application instructions.

Residents can also contact NC 2-1-1. This hotline helps people find food programs, housing assistance, medical services, or transportation support.

How to Stabilize Your Finances While You Search for Work

Financial stabilization begins with a careful review of expenses and the removal of anything unnecessary. Households should track every expense to understand where their money goes. This helps identify costs that can be reduced or temporarily eliminated.

People usually focus on:

- Switching to cheaper mobile phone plans

- Reducing entertainment expenses

- Temporarily canceling a gym membership

- Reviewing insurance terms

- Avoiding new credit card debt

Many banks and credit unions offer support programs for customers facing difficult situations. This may include lowering overdraft fees, deferring payments, or offering a more flexible loan repayment schedule. That is why it is important to contact your bank and find out what options are available.

It is also helpful to review subscriptions and cancel those that are not being used. In many families, money continues to be withdrawn for apps, streaming services, and other unnecessary subscriptions. Canceling them helps free up part of the budget.

How to Rebuild Your Income Through Gig Work

Job searching often takes time. Therefore, many Triad residents take temporary or seasonal jobs to make up for the decrease in income. The region regularly has openings in warehouses, manufacturing facilities, call centers, and retail stores. Large staffing agencies also operate here, such as Kelly Services, Adecco, and ManpowerGroup.

Short-term income can also be earned through gig platforms such as food delivery, ridesharing, freelance work, or performing small household tasks. It is important to remember that the IRS considers this type of work self-employment. If the income is high enough, it may be necessary to pay taxes quarterly.

Training programs help people move into new professions. Guilford Technical Community College, Forsyth Technical Community College, and other regional educational institutions offer affordable certificate programs in manufacturing, information technology, healthcare, and logistics. Some programs meet the federal requirements of the Workforce Innovation and Opportunity Act.

The NCWorks service organizes job fairs, offers resume writing tips, and assesses applicants’ skills. People who use these resources generally find employment faster, since many Triad employers work with these centers.

Make Strategic Moves to Rebuild Your Finances

Losing a job is a difficult and stressful event. But residents of the Triad have many resources and programs that help manage basic expenses. If you plan your steps, set priorities, and use the available support, a family can get through a period without income.

Unemployment benefits, government programs, social assistance, more careful planning of expenses, and temporary work help cover basic needs — housing, utilities, food, medical care, and transportation.

Recovery also depends on the individual’s own efforts. Searching for a permanent job, participating in training programs, taking temporary projects, or retraining can help you return to a stable income more quickly.

Join the First Amendment Society, a membership that goes directly to funding TCB‘s newsroom.

We believe that reporting can save the world.

The TCB First Amendment Society recognizes the vital role of a free, unfettered press with a bundling of local experiences designed to build community, and unique engagements with our newsroom that will help you understand, and shape, local journalism’s critical role in uplifting the people in our cities.

All revenue goes directly into the newsroom as reporters’ salaries and freelance commissions.

Leave a Reply